Sell Agency vs Keep Agency

Let’s begin by stating the obvious: selling your business is a huge milestone in the life of an entrepreneur. The decision to sell your agency is usually driven by a punchy cocktail—a mixture of one’s growing ego, dreams of cashing out, and validation that one has built a valuable enterprise. Too few agency owners compare the cash flow scenarios between selling and keeping their business once they've made up their mind to sell. This eye-opening comparison should absolutely factor into your eventual exit strategy.

To be clear, the content below is not tax advice. For tax advice specific to your individual situation, please contact an experienced tax attorney that you trust. The information below is simply designed to help you compare the cash flow implications of selling versus keeping your business. My hope is that this information will help you think differently about succession planning. At the very least, it should aid you in having informed conversations with your tax advisor.

Liquidity Event

The goal of selling your business is to create a liquidity event—an opportunity to put some cash in your pockets. Reasons for seeking a liquidity event vary, but may include:

You want to cash out: Business is doing well and you want to take some money off the table.

Not making enough money: You are hopeful that outside investment can turn the business around, like we see on television shows such as The Profit.

Burnout: You’re looking for a change of pace.

Health problems: A succession plan is the business equivalent to having a will or a living trust.

Retirement: You no longer want to run the business.

Now, let's look at two different cash flow scenarios for a creative agency that has an annual profit of $500K. Many agency owners do not have visibility to these cash flow scenarios until they've received a valuation. This involves having spent substantial amounts of money consulting with accountants and an attorney to sell their business.

Assumption: You have a creative agency with annual profit of $500k.

Scenario 1: Sell Agency

Let's assume you are able to find a buyer willing to purchase your agency for 2x profit (or EBITDA, so you're using the correct lingo). This amounts to a $1M sale of your business. With a $1M sale, you could expect to pay capital gains tax of about 20%, leaving you with $800K after taxes. Congratulations! You now have $800K to invest in personal or entrepreneurial endeavors. Next, let’s say you put that money in the stock market or another investment vehicle and expect to receive a 10% annual return (pretax earnings of $80K). If the tax rate is 22% on those earnings, then the after-tax income would be $62,400.

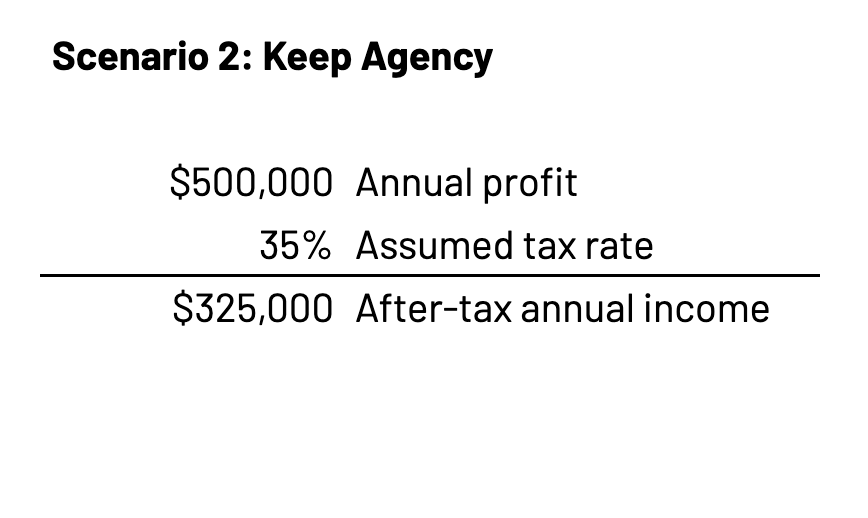

Scenario 2: Keep Agency

Cash flow implications are vastly different when you are looking at keeping your business. We will use the same assumption of an agency with annual profit of $500K. This profit gives you an assumed tax rate of 35%. With this tax rate, you could expect to take home $325K after taxes.

What Does This All Mean?

It’s true—at first glance, the expected annual cash flow between the two scenarios seems drastic. Usually, the pushback I get sounds something like this: "In Scenario 1, I have $800K in cash sitting in an investment account. So, I can always add to the $62,400 per year." Although this statement is technically correct, it fails to recognize that they have an asset valued at $1M in Scenario 2.

The point of this illustration is simple: to show the cash flow differences in keeping versus selling your business. Typically, when an accountant reveals this math to an agency owner in the selling process, many decide to delay selling their business in order to increase their valuation. The truth is that the numbers won't change much in a year or two. This is the dirty little secret to agency ownership. With this in mind, you should use the cash from your business to build wealth outside of your business. Your focus should be on getting rich while you own the agency—not when you sell it.

Clients often approach me for advice on whether or not to sell their business. In these scenarios, I usually advise them to keep the agency (an income-producing asset) and hire a president/managing director. Having a well-run agency is a liquid asset that fits well into most estate plans. You could see the benefits of hiring a managing director for $100K to replace you while still being able to sweep up more than $200K+ in profits every year (in the above scenario).

Closing Thoughts

I invite you to run the numbers for yourself and assume you'll be able to secure 2X of your current EBITDA. You may be able to sell for more than 2X EBITDA; this conservative approach simply helps us make a rational decision as to whether we should keep or sell our agency based on current cash flow. If you're interested in talking through your cash flow scenarios, then you should check out our Agency Coaching service. Through this advisory service, we help agency owners and their leadership team better understand how these diverse scenarios fit with their individualized succession plans.