Are you Putting All Your Eggs in One Basket?

Many businesses make the mistake of concentrating on one or two clients. In theory, this idea is reasonable; it’s easier to service these key customers than it is to be spread too thin. But what happens if these customers decide to no longer use your services? You're left scrambling for other opportunities, and end up losing money as a result.

To avoid these situations, risk management must come into play. This is the second article in my new foundational series: the breakdown of agency metrics. My intent is to help you better understand where and how value is being created or squandered in your agency.

What is Client Concentration?

Client concentration measures how total revenue is distributed among your clients. Place yourself in the shoes of an outside investor looking in at your business. One of the first things you would determine is whether the revenue drivers are diversified or concentrated. That would mean finding answers to the following questions:

Which services are driving revenue?

Are there long-term contracts in place, or is work mostly project-based?

Does the agency have high client concentration—defined as one client representing more than 25% of revenues?

The formula to calculate client concentration for each client would look like this:

(Revenue from client / Total revenue from all clients).

Here's an example. Say one of your clients was responsible for $400k of your $1M business; in that case, the client concentration for that client would be 40%.

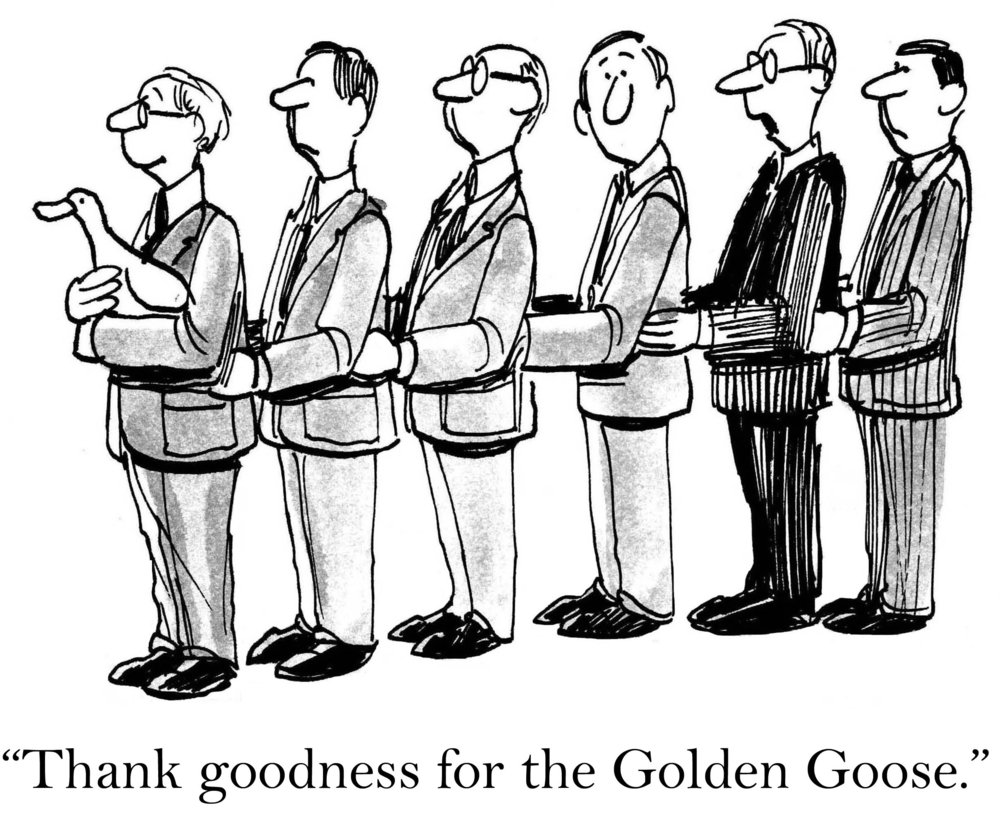

This example illustrates an agency with high client concentration. We refer to this as the Golden Goose Syndrome: where you rely on one or two clients to provide the bulk of agency revenues. As a good rule of thumb, you do not want one client representing more than 25% (high concentration) or more of revenues. There are inherent risks with having a golden goose (high concentration) and multiple smaller clients (low concentration).

Client Concentration Risks

A piece of bad advice tends to circulate around our industry. It claims that one “whale,” “gorilla,” “anchor,” or “golden goose” is all you need to keep your business afloat. (Side note: I never realized how many synonyms we use to describe large clients in our industry.) This is flawed thinking; it states that each subsequent client is considered a bonus, since you have stable income.

Unfortunately, that business model is ideal for a freelancer looking for the financial security of an employer without having a full-time boss. Of course, there are nuances to this situation. When you are scaling, you want a golden goose to not only validate your business model, but also to ensure you can cover overhead expenses. However, there is a risk to your long-term sustainability if you cannot grow your other clients to a similar size.

Golden Goose Risks

They tend to be overly demanding. They seem to know they are your biggest client, and this causes them to make last-minute requests that always need to be handled immediately. You are nervous to push back because of how much of your billings they represent.

They exert downward pricing pressure. As much as you want to negotiate, you both know who has the most leverage in negotiations.

When you lose the golden goose, you lose the income before you lose the expenses. All those folks you hired to service the account are now sitting on your bench with no clients to service.

Complacency usually sets in. Because the golden goose is so demanding, you tend to over-invest time with them, leaving little time for business development.

When investors assess the value of your business, high customer concentration is viewed negatively. The risks of losing a golden goose lowers investor confidence.

Multiple Small Client Risks

They tend to get over-serviced just like your larger clients—except the profitability is not built into these smaller contracts to compensate the additional time you're spending on them.

They create an inherent profitability risk when collectively, they represent a large percentage of revenue and your profitability with each client is small.

Ways to Mitigate Client Concentration

Get comfortable saying "no" to prospective clients who are not a good fit for your agency.

Focus new business development efforts on your ideal clients (not too big and not too small). In another article, I'll go into detail on how to determine which clients are a good fit.

Increase your hurdle rate for clients. Investors refer to a hurdle rate as the minimum rate of return required on a project. A hurdle rate gives your agency insight into whether you should pursue a specific project. In general, each client should provide a minimum 15% rate of return. You'll be above and below this on individual projects; but overall, you want to aim for this amount for each client.

Key Takeaway

Don't place all your eggs in one basket. Admittedly, I might be taking this golden goose analogy too far. However, I do want to be clear that I'm not advocating against pursuing a whale client. I'm saying that once you land the whale, be vigilant about landing a second or third client the same size; otherwise, that one large client will have a stranglehold on your agency. You want to lower your overall risk exposure by spreading risk out as much as possible, like how you would manage an investment portfolio.

Client concentration is one of the key performance indicators we focus on when developing your agency scorecard. Check out our Agency Ops service to learn more about how we can help you mitigate client concentration and rightsize your agency business.