Reading your Cash Flow Statement

Keeping an orderly cash flow is essential to running a sustainable marketing agency. Without sufficient cash flow, it is nearly impossible to keep your business afloat. In fact, I would argue that the greatest financial challenge you face is managing an uneven cash flow.

Recently, we reviewed income statements to help us better understand two factors:

How much money your business spends

How much money your business earns in a specific period.

Although the income statement shows us profit and loss, it doesn't tell us how much cash we have on hand. The cash flow statement (also known as the statement of cash flows) outlines the sources and uses of cash during the same time period as your income statement (e.g., month, quarter, or year). As such, the two statements go hand-in-hand when it comes to understanding your business.

From our conversations, I know many of you don't review a cash flow statement; instead, you review your income statement on a cash basis to determine whether your business is producing enough cash to pay for expenses. Admittedly, this could work if you don't have much in the way of accounts receivable (meaning people pay you upfront for your work) and you don't have many financing or investing activities. In this specific case, looking at your income statement on a cash basis will provide a good enough read on your cash position. But in most other situations, establishing a cash flow statement is key.

3 KEY SECTIONS OF A CASH FLOW STATEMENT

The cash flow statement is divided into three segments. These sections work together to show the different ways cash enters and leaves your business.

Operating Activities: Cash outflows from operating activities—including salaries, payments to vendors, office rent, and taxes. Cash inflows include cash received from regular business activity, i.e., providing marketing services for your clients. This section highlights whether you are generating enough cash from operations to keep your business afloat.

Investing Activities: Cash outflows from investing activities typically include computer equipment, an office building, or the purchase of equity in another business. Cash inflows from investing activities would be the opposite of these transactions; for example, selling a building or selling your stake in another business.

Financing Activities: Cash outflows from financing activities are usually the repayment of loans. Cash inflows include borrowing cash in the form of a loan, and issuance of equity to employees or outside investors. This section is primarily focused on reviewing how much money you borrowed to finance operations.

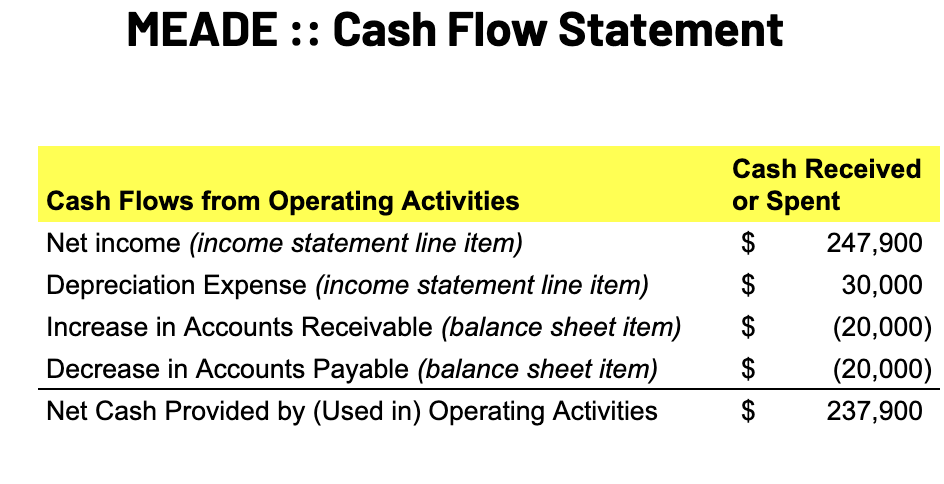

SAMPLE CASH FLOW STATEMENT

To prepare a cash flow statement, you will need to consult several documents: the current year's income statement, and the current and last year's balance sheet.

The top line of your cash flow statement starts with net income from your income statement. After adjusting for the impact on cash from operations, investing, and financing activities, you can then determine the actual cash available on hand. The example below shows what your cash flow statement may look like. (Note: I am only including the operating activities sections, since most small to mid-sized agencies don't have much in the way of investing and financing activities).

QUESTIONS THAT YOUR CASH FLOW STATEMENT ANSWERS

Which clients paid their bills during the period shown on the statement?

How much cash was spent during the period?

What was the change in cash balance at the end of the period?

How much cash is available to invest in assets or operations?

How much cash do we need to raise in order to pay our bills?

KEY TAKEAWAY

Despite its usefulness, the cash flow statement is often overlooked. It is an invaluable asset that details sources of cash, how its being used, and the additional cash needs (or surplus cash your business has on hand).

The operating activities section reveals the amount of cash generated or lost from delivering marketing services.

The investing activities section reveals whether your business reinvested in assets or sold assets to fund current operations.

The financing activities section reveals how your business is financing long-term operations, payments of obligations, and payments to owners.

In a nutshell, long-term positive cash flow indicates a growing business, while sporadic cash flow signals a need to adjust business plans.

My goal with this article was to help you unlock a better understanding of how cash moves through your business. If you're interested in learning how you and your team can better interpret the data in your financial statements, then please reach out about my profitability workshop. Initially designed for breakout sessions at conferences, I have customized the plan to create half-day sessions on-site with creative agencies like yours. I will use your financial statements to give you a better read on your financial health and offer specific steps to improve moving forward.